Investment Philosophy

It is our belief that investors are loss averse not risk averse, but understand that not all managed funds are suitable for all clients. Our investment approach is focused on preserving capital, growing wealth and managing risk.

What do we do?

We build, run and monitor portfolios, both at a strategic level for allocation and the fund selection.

Through One Four Nine Portfolio Management’s Managed Portfolio Service (MPS) we provide risk rated models across five ranges and five risk profiles to meet your varying needs. Each portfolio is constructed, carefully monitored and rebalanced by the One Four Nine Portfolio Management investment team.

We construct active, passive, blended, sustainable and income versions of our portfolios, whereby the asset allocation is decided by a trade-off between equities (the growth for returns) and non-equities (the diversification and loss protection). Each Model Portfolio aims to achieve its objectives through investment in a global multi-asset portfolio consisting of equities, bond, commercial property and other asset classes. Exposure is primarily gained through collective investment schemes (unit trusts, OEICS, investment trusts, ETFs).

Through the creation of our own forecast models for each asset class we can predict the entire return distribution and understand the type of loss a portfolio may encounter in the future. The asset allocation of each portfolio is determined by maximising the forecasted return for a given level of risk. Our model portfolios are maintained by an internal strategy group led by One Four Nine’s Chief Investment Officer and scrutinised by an external governance committee.

Our Portfolios

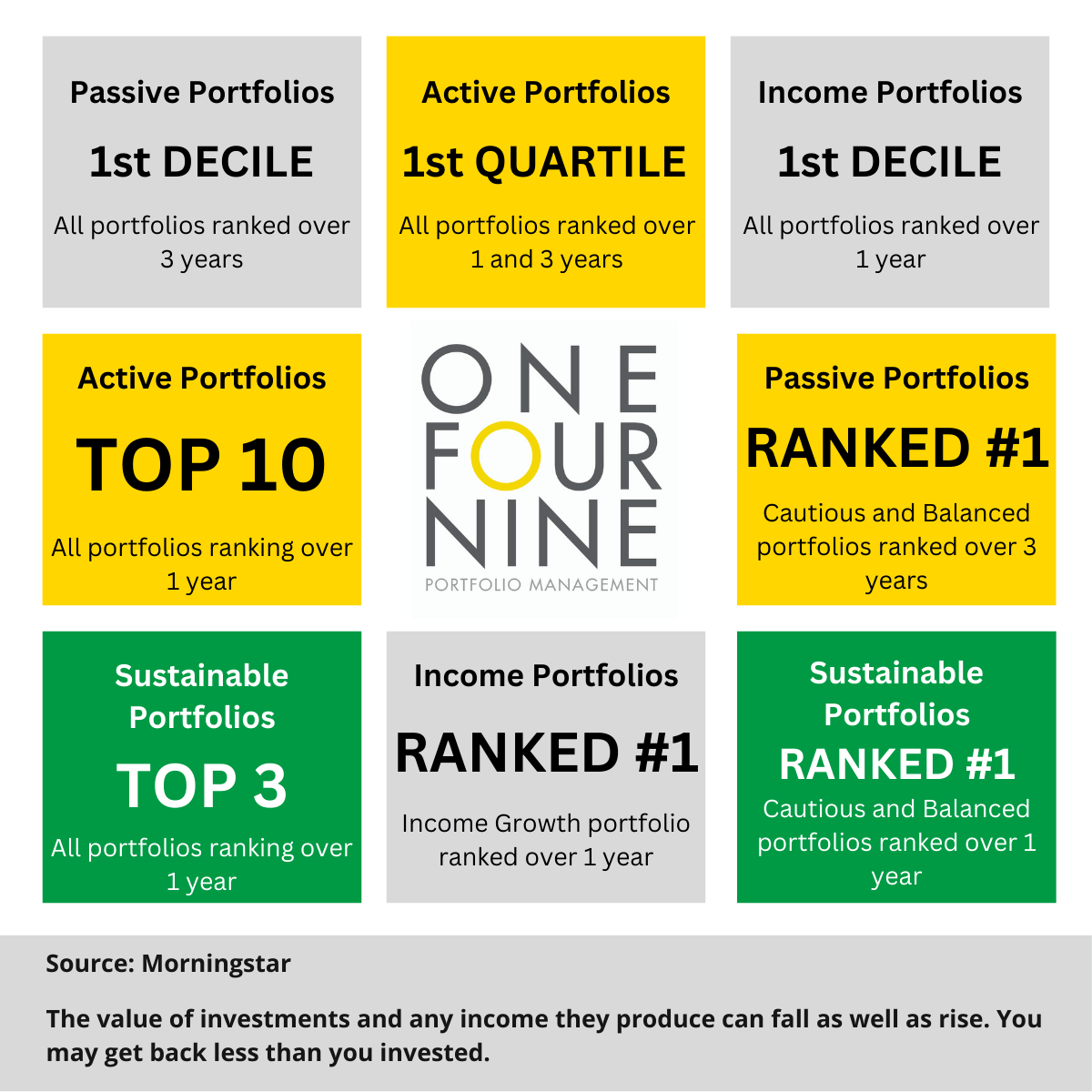

Five risk rated active model portfolios

Investing predominantly in actively managed funds. See the latest factsheets below.

Five risk rated passive model portfolios

Investing solely in passive and index funds, but with the same asset allocation as the actively managed portfolios. See the latest factsheets below.

Five risk rated blended model portfolios

Five risk rated model portfolios investing in a blend of active and passively managed funds. See the latest factsheets below.

Five risk rated sustainable model portfolios

For investors looking to make a difference with their money we offer five risk rated sustainable model portfolios. See the latest factsheets below.

As part of our research process, we seek to establish the most appropriate funds for our portfolios. This may mean that some sustainable funds within our portfolios are based overseas, such as Ireland and the following FCA notice is applicable.

‘This product is based overseas and is not subject to UK sustainable investment labelling and disclosure requirements’

Further information concerning the FCA sustainability labelling and disclosure requirements can be found here.

Three risk rated income model portfolios

For investors looking for a natural and growing level of income, we offer three risk

rated income model portfolios – investing in a mixture of passive and active funds. See the latest factsheets below.

The value of investments and any income they produce can fall as well as rise. You may get back less than you invested.