Monthly and Year to Date Portfolio Performance

May 2025

Markets stabilised somewhat in May after a volatile couple of months with yoyo-ing tariff policy announcements. Sovereign bonds struggled over the month as recession worries eased and concerns over the sustainability of government debt grew. This caused a steepening of the yield curve with longer duration holdings hurt more than those at the shorter end. It was a different story in credit where short dated investment grade and high yield enjoyed positive returns over the month. Global equity markets rallied over the month (4.9%) led by the US (5.4%) and style wise, Growth (7.66%) outperformed Value (2.08%) over the month. Finally, sector wise Information Tech (9.43%), Industrials (7.12%) and Consumer Discretionary (6.80%) led the way whilst Healthcare continued to be out of favour, down (-4.55%) over the month.

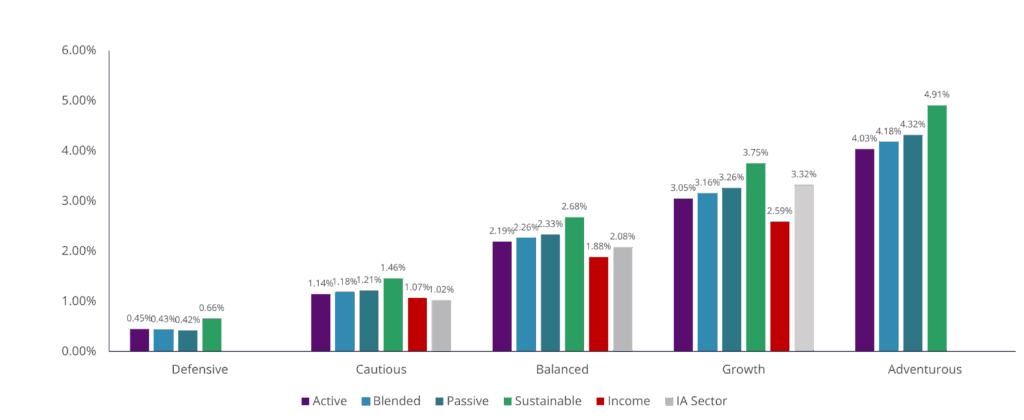

All of this meant strong returns for our portfolios over the month, both in absolute and relative terms, with the Sustainable range enjoying the best returns over the month. The Passive portfolios slightly outperformed the Active ones and the Income range, due to its higher weight to the UK and its value tilt lagged the other ranges slightly.

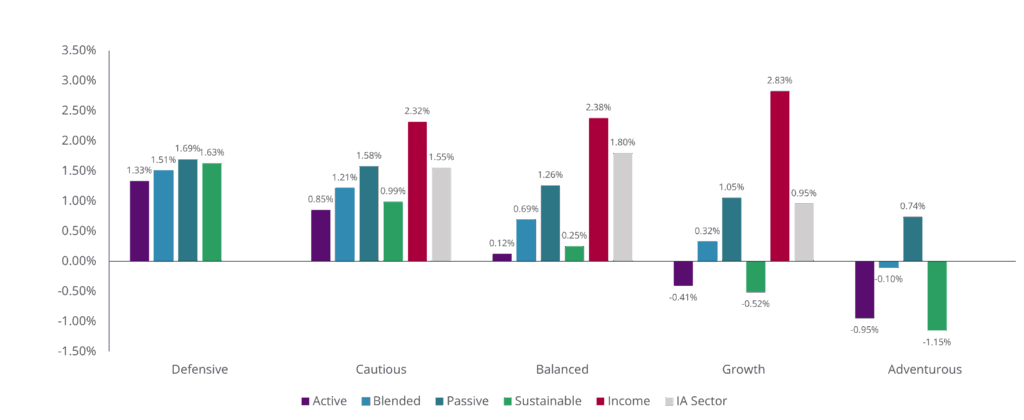

Year to Date 2025

Thanks to a strong May, most portfolios have returned to positive territory YTD. The Income range has enjoyed the best performance returning between 2.32% and 2.83%, followed by the Passive range which has returned between 0.74% and 1.69%. The Active range has returned between -0.95% and 1.33%, and Sustainable between -1.15% and 1.63%.

The value of investments and any income they produce can fall as well as rise. You may get back less than you invested.