Portfolio Review – Q4 2023 – Issue 21

This is the latest One Four Nine Portfolio Management (OFNPM) portfolio review providing investors and advisers with an easy to digest overview of what’s happening in the markets globally, alongside comparisons of OFNPM’s portfolio performance each quarter and throughout the year.

Chief Investment Officer’s comments

Central banks mostly kept rates on hold during the last quarter of 2023. The Federal Reserve last raised rates in late July of 2023 and the Bank of England in early August of 2023. The European Central Bank was a little bit later but last raised their base rate in late September 2023. Since then central banks have kept rates at their current levels and the market has played a guessing game of whether the next move will be up (early October) to when the first rate cut will happen (November and December) hanging on every word uttered by policymakers and keeping a keen eye on inflation data.

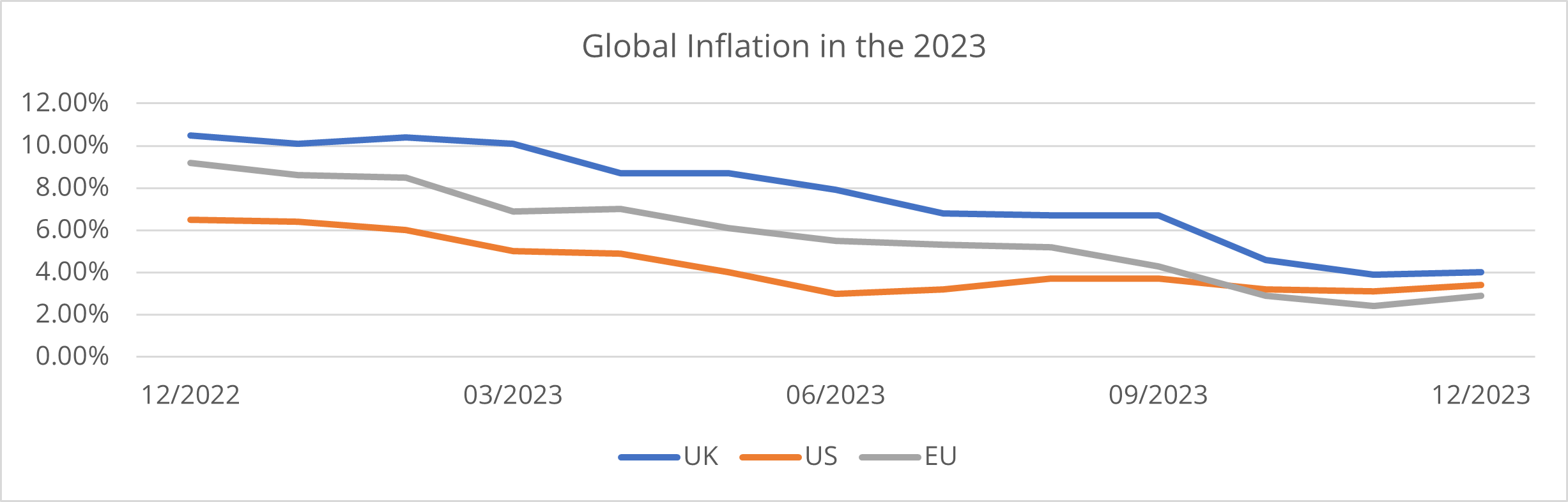

The halt in rate rises has been driven by a slowdown in inflation and in the main inflation either not surprising significantly on the upside or surprising slightly on the downside. The chart below shows how inflation has reduced during 2023, with the largest movements coming in the first half of the year.

In the US inflation fell to 3% by June and has remained between 3% and 4% ever since. In the UK and EU there are signs that it too is stalling between around 3% to 4%, all well above central bank targets of 2%.

This is why central banks in October warned that rates would stay higher for longer, and so the market having bid up bonds on the hope that rate cuts may happen sooner than expected, sold off bonds. This was short-lived though as increasingly dovish comments emerged from policymakers. Then at the Feds December meeting, The Fed softened its tone considerably with more dovish language from Chair Powell. In particular, the Fed changed the statement “In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time” by inserting “any” before “additional”. This has now been called the Fed Pivot.

The insertion of the word any caused a significant rally in bonds and equities into year end as markets read into the statement that future rate rises were off the table. Yields fell considerably and the market brought forward its expectations for the timing of the first rate cuts to Q1 for the US and mid Q2 for the UK. Ever since central banks have been attempting to roll this back. They have been doing so because inflation does remain well above target still and economies seem to be coping with higher rates, the US especially so. While the UK and EU will probably flirt with a very mild recession, the US is still growing strongly, consumer confidence has not deteriorated significantly and importantly the jobs market continues to remain strong as does wage growth. None of which suggests rate cuts in the first quarter of 2024, as these are fertile conditions to re-ignite inflation before it is back to target.

Inflation is coming under control

We continued to hold our tactical asset allocation position of short duration within the fixed income portion of the portfolios during the quarter, even though we missed out on some of the rally in bonds. When we placed the position in early 2020 yields on government and corporate bonds were at all-time lows and we felt that there was a significant asymmetry in the pay-off from bonds for investors. All the risk was on the downside and so we reduced as much risk as we could within the fixed income allocation by allocating all our fixed income to short-duration bonds. This worked well for us protecting us from the rate rises that followed driven by inflation at levels not seen for a generation.

We now believe that we are at the end of the current rate rising cycle. Inflation is coming under control, although maybe slower than central banks would like as evidenced by the UK December’s inflation rate coming in above expectations. The path to the Bank of England’s target inflation of 2% will be rocky but given the weakness of demand in the economy with wage-push factors dissipating we cannot see where policymakers would want or have room to further increase interest rates. This is the same in most developed economies and the Federal Reserve has already softened language around potential rate rises. We don’t however feel that rate cuts are just around the corner. Rather we think that we may see rate cuts in the second half of 2024 and that central banks globally will wait until there is real confirmation that inflation has eased back to target and that this is sustainable for the foreseeable future before they initiate any monetary easing.

Moreover, we do not expect rates to head back towards the “emergency” levels of 2008 to 2021. Central Banks will want to keep some rate powder dry for the next existential crisis they may face, whatever that may be. We do think that this rate easing cycle will be shallower than previous cycles. We also note that spreads of corporate debt over sovereign debt are in the lowest quartile of spreads historically and therefore feel that we are not being paid correctly for our credit exposure. This is true across all investment-grade bonds and is particularly acute in the US.

We expect the US to be the first central bank to move on rates and that the BOE and ECB will follow, but not immediately. The ECB President Christine Largarde has already said as much suggesting that the first rate cuts may not come until the summer.

Equities also benefited from the more dovish tones from the central banks and rallied hard into the year end. We feel that at present valuations equity prices are elevated and that there is more risk to the downside. The vast majority of the positive return we experienced last year in equity markets was driven by increased valuations and not by increased earnings. In most regions, we saw a fall in earnings and this is not conducive to further long-term equity price increases, although momentum has a funny way of persisting in markets so they may well rally for longer than expected.

Market Performance

Markets reacted to softening inflation and increasing dovish tones from central bankers regarding weights by rallying in the last two months of the year. This turned what was looking like a flat year for returns into a year where good money was made across most asset classes and sectors, masking weak performance.

In the UK the ten-year Gilt yield fell from 4.44% at the end of September to 3.54% by the end of the year. The falls in yields were similar across the yield curve as the 30 year yield fell 76 basis points from 4.9% to 4.14% and the 2 year yields fell 93 basis points from 4.91% to 3.98%. Only at the very short end, 3 months, did yields remain relatively static with the 3-month yields only falling from 5.44% to 5.29%. The falls were driven by longer expectations of rate cuts, whereas the market continued to discount rate cuts in the near term.

Gilts overall gained 8.6% over the quarter, its biggest quarterly rise since Q3 2011. Returns were positive across the maturities with short gilts rising 3.4% and long gilts rising 13.2%. Index linked gilts performed in line with conventional gilts rising 9.5%. Higher returns in sectors were driven entirely by higher durations as the yield curve shifted downwards rather than tilted.

Sterling investment grade credit also performed strongly gaining 8.4%. Short dated investment grade credit lagged behind, due to lower duration, but still returned a credible 4.6%. Spreads on the whole continued to narrow, testing their all time lows.

Equities rebounded strongly as the cost of capital fell with lower yields. Global equities gained 6.7% in sterling terms over the quarter with growth stocks (+8.5%) and quality stocks (+7.7%) leading the way outperforming value stocks (+4.7%). Almost all regions and sectors provided positive performance over the quarter, but again there was significant differentiation.

Europe was the best performing region gaining 7.6% in sterling terms followed closely by the US which gained 7.1%. the UK returned just 3.2% lagging behind yet again. Positive returns were also to be found in Japan (+3.6%), Asia Pacific (+3.3%) and emerging markets (+3.3%). Returns were driven more by the expansion of valuations than by an increase in fundamental earnings.

This has been a concern this year. While returns have been good, and spectacular in some regions, the forces behind these returns have been a re-rating of stock, rather than increased earnings. The table below shows the returns of six equity regions, in local currency terms, broken down by return due to income, inflation, change in valuation and growth in real earnings.

| Returns 2023 | Total Return | DY | Inflation | Real Capital Return | PE Change | Real EPS Growth |

| UK | 7.66% | 4.13% | 4.69% | -1.24% | 3.62% | -4.75% |

| US | 26.49% | 1.18% | 2.99% | 21.39% | 26.87% | -4.30% |

| Japan | 28.56% | 2.13% | 2.50% | 22.81% | 13.58% | 8.14% |

| Europe ex UK | 14.30% | 2.75% | 2.76% | 8.25% | 6.59% | 1.56% |

| Asia Pacific ex Japan | 7.99% | 2.97% | 1.04% | 3.80% | 14.10% | -9.01% |

| Emerging | 10.27% | 3.05% | 1.65% | 5.27% | 19.18% | -11.64% |

The best-performing region was Japan with a total return of 28.6%, and a dividend of 2.1%. Once we adjust for dividends and inflation the real capital return from Japan was 21.,4%, of which 13.4% was due to expanding valuations and 8.1% from increased earnings. In contrast, the US delivered a similar total return and real capital return, but it was entirely driven by increased valuations. In fact in the US real earnings were negative over the year contributing -4.3% to returns.

In the UK returns were much lower and real capital returns were actually negative. The UK also experienced some valuation expansion, although nowhere on the scale of the US, but suffered negative earnings in line with the US, Finally, both Asia Pacific and Emerging markets suffered significant retrenchment of returns over the year with expanding valuations!. A worrying sign This makes us cautious about the outlook for equities in 2024 as we look to see if earnings can rebound to fill the valuation void that has opened up within equities. If not then prices will have to readjust downwards to bring back valuations to more sensible levels, especially in the US.

Portfolio performance

Your portfolios generated positive returns over the quarter, with higher risk portfolios outperforming lower risk portfolios. The table below shows returns for Active, Passive and Sustainable portfolios, alongside the returns of their respective inflation benchmarks and for comparison purposes their appropriate IA sector over the quarter.

| 3 Months to 31 December 2023 | Active | Passive | Sustainable | Inflation Benchmark | IA Sector |

| Defensive | 4.40% | 3.87% | 4.71% | 0.26% | |

| Cautious | 4.73% | 4.18% | 5.25% | 0.51% | 5.68% |

| Balanced | 5.30% | 4.70% | 5.98% | 0.75% | 5.68% |

| Growth | 5.56% | 4.99% | 6.52% | 1.00% | 5.77% |

| Adventurous | 5.67% | 5.14% | 6.75% | 1.25% |

Source: Morningstar

Portfolios with higher weights to equity performed better as equity markets rallied towards the back end of the year. However those with higher fixed income weights also benefitted from the fall in yields over the quarter and our extension to duration. Our non-equity assets gained 4.5% over the quarter while our active equity funds gained 6% outperforming our passive equity funds which gained 5.5%. In terms of relative performance, the Passive portfolios underperformed their IA equivalents however our Active and Sustainable portfolios outperformed their relative IA sectors at the higher risk end, but underperformed at the Cautious end.

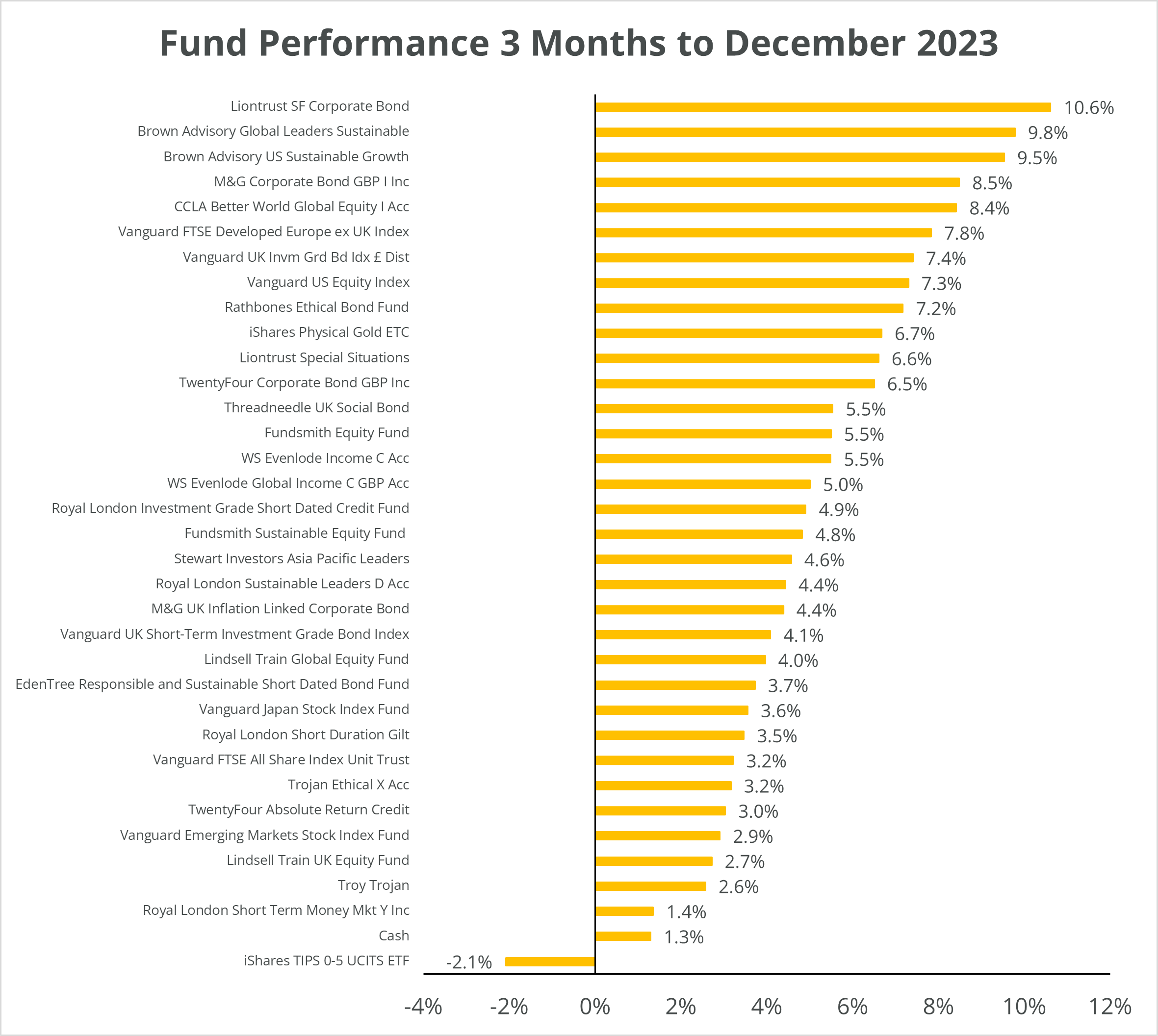

The chart below shows the returns of funds within the portfolios for the quarter.

Source: Morningstar

All of our bond funds, both active and passive, posted positive returns over the quarter, with the exception of iShares TIPS 0-5 which was down 2.1% in sterling terms but up in USD. Our sustainable bond funds performed slightly better than our general bond funds and our longer duration bond funds experienced the best performance over the quarter. Our bond funds when viewed as a portfolio gained 4.92% over the three months to December.

All our equity funds, both active and passive, rose over the three months to December. Most of our active funds outperformed their reference benchmarks as they have little or no exposure to the energy sector, which was the worst performing sector over the period down 8.2%. Information technology, which we do have decent exposure to, was the strongest performing sector, up 12.5% over the quarter. Those funds that had a bias towards small and mid cap stocks also outperformed. Our best performing active equity funds over the quarter were Brown Advisory Global Leaders Sustainable, Brown Advisory US Sustainable Growth and CCLA Better World Global Equity. Our worst performing active equity fund was Lindsell Train UK which suffered from idiosyncratic issues with some holdings.

We remain committed to our equity growth bias within portfolios, not least because the majority of our funds have continued to report that their underlying holdings have on average grown their earnings over the year. We invest for the long-term growth in earnings rather than try to trade the valuation cycle.

Portfolio outlook

We performed a minor rebalance of our Active, Passive and Sustainable portfolios in November 2023. This change was precipitated by our wish to sell one of our active fund holdings, Matthews Asia ex Japan Total Return fund. We used the proceeds of the sale to partially reduce our weight to Asian equities and increase our weight to US equities.

This was a structural change to our equity asset allocation rather than a tactical change. For some time, we have felt that we have been significantly underweight US equities and wish to have a higher long-term weight to the region. What has held us back has been the elevated levels of valuation in the US relative to other regions. The sell off in US equities in between August, September and October allowed us to increase our weight at a fairer valuation. The moves were not large with the biggest weight of the Matthews fund at 4% in the Adventurous model. We placed around 75% of the Matthews weight into the US, retaining the rest in the region, adding to our other existing Asian fund, Stewart Asia Pacific Sustainable Leaders fund.

This naturally changed the asset allocation of the Active portfolios and so we made changes to the Passive portfolios to bring their asset allocation in-line with the look through asset allocation of the Active portfolios.

Find out how One Four Nine Portfolio Management invest here.

Dr Bevan Blair,

Chief Investment Officer,

One Four Nine Portfolio Management

London, Friday 01 March 2024.

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.

All data is at 31 December 2023. One Four Nine Models are benchmarked against UK CPI and any other benchmark has been displayed for comparative purposes only and is not a benchmark for the Models. Performance figures are net of underlying fund fees and include One Four Nine Portfolio Management’s Management Fee of 0.24% (including VAT). All model portfolio performance data is sourced from One Four Nine Portfolio Management. All other data is from Bloomberg and Morningstar.

This service is intended for use by investment professionals only. This document does not constitute personal advice. If you are in doubt as to the suitability of an investment, please contact your adviser.

One Four Nine Group Limited Registered in England No: 11866793. One Four Nine Portfolio Management Limited is registered in England No: 11871594 and is authorised and regulated by the Financial Conduct Authority (FCA) FRN: 931954. One Four Nine® is a registered trademark.