Portfolio Review – Q3 2022 – Issue 16

This is the latest One Four Nine Portfolio Management (OFNPM) portfolio review providing investors and advisers with an easy to digest overview of what’s happening in the markets globally, alongside comparisons of OFNPM’s portfolio performance each quarter and throughout the year.

Chief Investment Officer’s comments

It has been an extraordinary quarter. Inflation remains stubbornly high and central banks are increasing their target interest rates at the rate of knots in the hope that they can get inflation under control. Global economies are slowing down and starting to retract with recession ever more likely, or in the case of the US already here. Apart from labour statistics other macro-economic data points towards anaemic global growth at best, re-enforcing our view that central banks will prioritise controlling inflation above all else.

Governments are keeping the fiscal taps on full flow to alleviate a potential slowing down in the economy increasing the overall debt burden even further, at a time when the cost of this debt is rising. This increased borrowing has been used to cushion the blow of inflation to the consumer with spending for the short term rather than long term investment, which is inflationary itself. Therefore, fiscal and monetary policy are working in direct opposition to each other, and it is causing increased volatility in markets, with little signs either are working to control inflation and grow the economy.

Record rate rises

The rate rises we have seen from central banks have been the largest and fastest in history, and all starting from rates at historical lows. They have been universal across developed economies, apart from Japan. The Federal Reserve in the US has raised its target rate 150 basis points from 1.75% to 3.25% over the quarter. Year to date it has raised rates by 300 basis points. You have got to go back over 40 years to a time when rates were rising faster, but from a much higher starting point. In 1980 rates rose by 400 basis points from 14% to 18%. Inflation in 1980 was running at 12.5% and the rises were an attempt to bring that rate down, and were ultimately successful. The cost however was a three year long double dip recession.

The US is not alone in this. Over the quarter the Bank of England raised rates by 100 basis points from 1.25% to 2.25%, its greatest hike since independence in 1997. This year it has raised rates by 200 basis points, the most ever, and double that of the previous record rate rise in 2004 of 100 basis points in the year.

Elsewhere it was no different. Over the quarter, the ECB raised rates by 125 basis points to 1.25%, Sweden 100 basis points to 1.75%, Switzerland 75 basis points to 1.0%, Norway 100 basis points to 2.25%, Canada 175 basis points to 3.25%, New Zealand 100 basis points to 3.0% and Australia 150 basis points to 2.3%. This has been truly global.

Tightening the belt

On top of all this rate hiking we have also seen central banks start programmes of quantitative tightening, reducing their balance sheets and selling off government and corporate debt they have built up over 15 years to fight the great financial crisis and more recently the pandemic. Global money supply as measured by M3 has fallen nearly 5% in the past 5 months, almost the largest drawdown since 2007. The Federal Reserve has reduced its balance sheet from $8.9 trillion to $8.7 trillion. The Bank of England will start its Gilt sale programme in early November. Monetary conditions are tightening everywhere in an attempt to curb inflation.

As central banks seem to become ever more hawkish, we have seen a rapid increase in rate expectations. In the US rates were expected to peak in March of 2023 at 3.5%. The market now expects them to peak at the same time at 4.5%. In the UK rates are expected to peak in May 2023 at 5.9%, whereas at the end of June 2022 they were expected to peak at 2.9%. The era of cheap easy money would appear to be over and it will have long lasting effects on the economy, with reduced global growth for the foreseeable future.

It is too early to tell if central banks actions will have the desired effect on inflation. It remains at very high levels across the globe, although there are signs the rate of increase may have at least plateaued. In the US inflation peaked at 9.1% in June and has now fallen to 8.2%, although this is slightly higher than expected. In the UK inflation is currently at 10.1% which is where it was at its July peak, but in Europe it continues to rise with inflation running at 9.9%.

There is more evidence that these increasing rates are influencing global growth. US Q2 GDP recorded a -0.6% annualised growth rate, which was the second quarter in a row of negative growth meaning the US is in a technical recession. In the UK Q2 GDP was 0.1%, but the market expects that Q3 GDP growth will be negative. Europe is growing still with GDP at 0.8%, driven by good growth in Italy and Spain. However, Germany’s growth was just 0.1% and France’s 0.5%.

How long does a lettuce last?

Finally, special mention must be given to the current chaos that is the UK Government. Over the last three months the UK Government has been rudderless with either a lame-duck prime minister or a fatally wounded one of her own making. The country has had four chancellors, two prime ministers (soon to be three) and rafts of ministerial resignations and sackings. It has had an unfunded fiscal statement and the most chaotic budget process in living memory when a budget was not even due. Markets hate instability and they have reacted in the only way they know, selling sterling assets, as confidence in the UK floods away. Interest rate expectations have risen faster than other western economies on the back of this, having a real effect on borrowing rates, especially mortgages. The currency has dropped in value with little prospect of a recovery, making imports significantly more expensive and thereby feeding into inflation. The Bank of England has had to act to ensure the solvency of pension funds by buying yet more government debt to prop up prices of long dated Gilts, in direct opposition to its aim of reducing its balance sheet. All this insecurity has meant that business cannot or will not make decisions to invest in the long term, either postponing plans or shelving them altogether for the foreseeable future. The consequence will be a longer, harder recession in the UK than would otherwise have been, with monetary conditions tighter and inflation lingering for longer. And the infuriating fact is that this was all avoidable, caused by a government only concerned about its own electoral prospects, with no thought or care for the real-world consequences. The only saving grace for most investors’ portfolios is that they are global in nature, but those with sterling assets have been hung out to dry.

Market Performance

Rising rates are bad for asset prices. This is because the price of an asset is just the sum of its discounted cashflows, and higher rates imply a larger discounting of future cashflows. The further out in time your cash flows the larger the discounting effect when rates rise, so assets with long cashflows suffer more than those whose cash flows are in the near term.

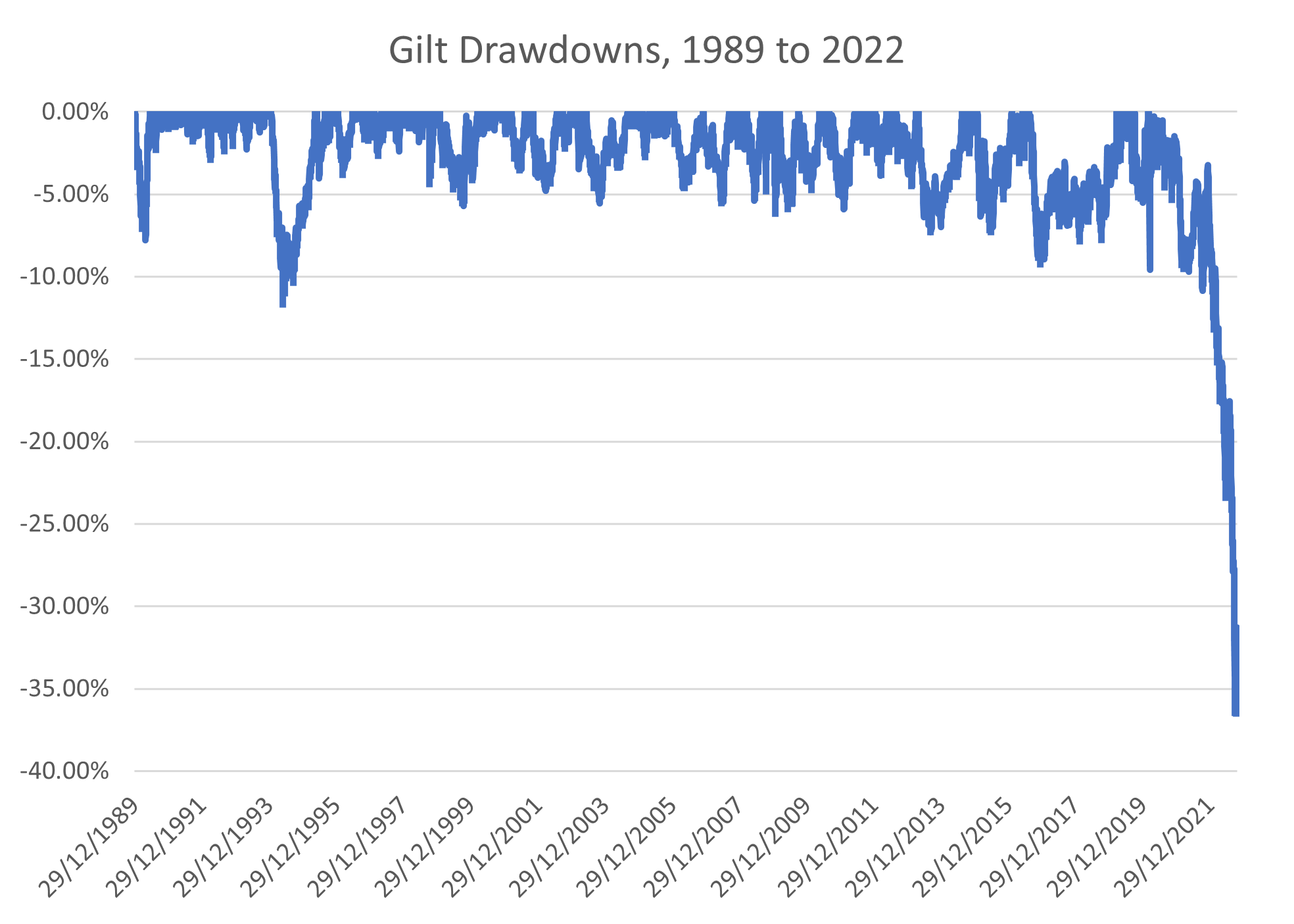

Last quarter saw the biggest sell-off ever for bonds. Rising yields across all bond maturities saw the price of debt plummet and its risk soar. To say the selloff was unprecedented is probably an understatement. The chart below shows the drawdowns of the ICE Bank of America Gilt Index from 1989 and it is the best illustration of what has happened to the bond market. The drawdowns we have witnessed this year have been three times higher than the worst period for Gilts since the Independence of the Bank of England and investors with low-risk profiles buying seemingly safe assets have suffered.

Gilts last quarter fell over 13.5% and year to date they have fallen nearly 25%. While earlier falls in the year were caused by the rising rate environment, the ferocious downward movement in sterling bond prices in the past quarter has been a direct consequence of the Government’s mini-budget, U-turns, deck changing and the markets’ lack of confidence in their financial stewardship.

Meanwhile the riskiness of bonds has soared. The volatility of Gilts has been nearly four times higher than historic norms. The three-month volatility of Gilts averaged 5.8% between 1989 and 2019 yet at the end of the quarter the volatility of Gilts stood at just over 22%. The longer the maturity the harder the fall and the higher the volatility. Long Gilts (those bonds with maturities over 10 years) fell over 18% during the quarter and are now down 37% year to date. Even at the short end (Gilts with maturities of less than 5 years) the index fell 5.9%, but at least it offered some protection.

Investment grade credit has not fared any better, with the broad index falling 12.5% during the quarter and short dated investment grade falling 6.9%. The drawdowns this year have been nearly 30%, although this was only double its previous drawdown during the great financial crisis.

In the short term, bonds have lost their ability to protect clients’ assets. This has had a knock-on effect in other asset classes, in particular commercial property, and real assets. UK Listed commercial property fell nearly 20% over the quarter. These have fallen in price because bond yields have risen, and investors have sold alternative assets to take advantage of higher interest rates. There has been a massive yield substitution effect – again protection has been lacking. These movements have had a disproportionate effect on low-risk portfolios, with lower risk portfolios suffering larger losses than higher risk portfolios. This has been a truly ‘black swan’ event. What may have taken years in terms of rising rates has taken place in a matter of months.

Global equities had a relatively quiet quarter with most markets falling slightly, but with no significant increase in risk. The S&P 500 fell 4.9% in dollars but was up 3.5% in sterling terms as sterling weakened by over 8% against the dollar over the quarter. The UK market fell 3.5%, European markets 2% while Japan was up slightly (+0.5%) in sterling terms.

Global equities gained 2.0% in sterling terms over the quarter. Growth stocks (+3.0%) outperformed value stocks (+0.9%), and the best performing sectors were consumer discretionary (+9.0%) and energy (+7.2%). The equity market is clearly waiting to see what effect rate rises will have on the economy and in particular earnings over the next few months, but they have appeared to have priced in a global recession already, and while volatility remains at elevated levels, this seems to be the best behaving market now.

Portfolio performance

Your portfolios generated a mixture of positive and negative performance over the quarter, with lower risk portfolios underperforming higher risk portfolios. The table below shows returns for Active, Passive and Sustainable portfolios, alongside the returns of their respective inflation benchmarks and for comparison purposes their appropriate IA sector over the quarter.

| 3 Months to 30 September 2022 | Active | Passive | Sustainable | Inflation Benchmark | IA Sector |

| Defensive | -1.55% | -2.16% | -3.30% | 1.90% | |

| Cautious | -1.13% | -2.10% | -2.46% | 2.14% | -3.62% |

| Balanced | -0.19% | -1.58% | -1.54% | 2.38% | -3.08% |

| Growth | 0.77% | -0.91% | -0.33% | 2.61% | -2.05% |

| Adventurous | 1.87% | -0.16% | 0.96 | 2.84 |

Our active portfolios slightly outperformed the passive portfolios over the quarter. This was driven by a number of our equity funds outperforming their benchmarks, benefiting from their growth bias. Our active bond funds also outperformed their passive counterparts providing protection in a falling market. The lower risk portfolios generated negative returns, but we were protected from the worst of the bond markets as we kept our positioning at the short end of the bond market. While not a benchmark our portfolios outperformed their respective IA sectors significantly.

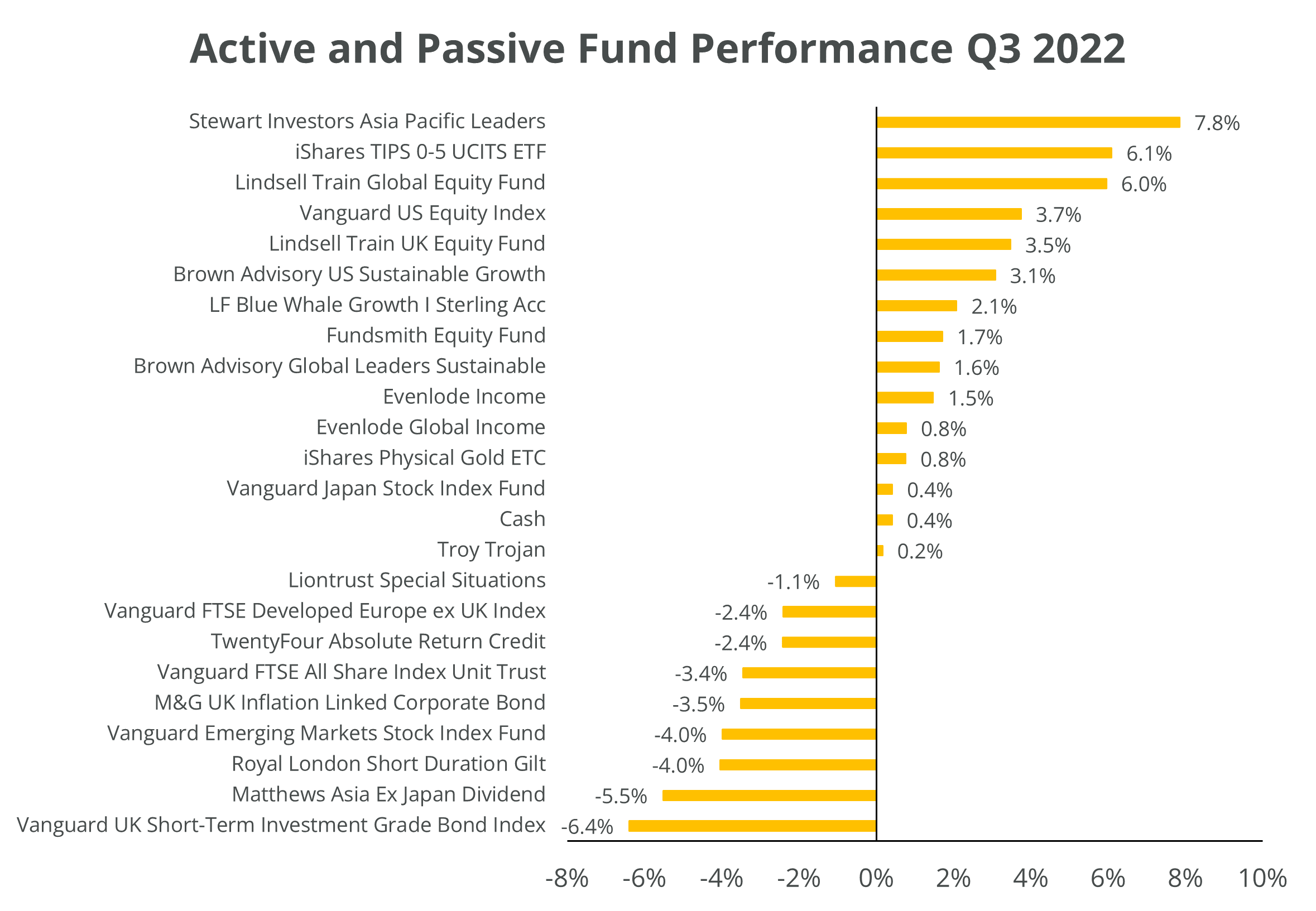

The chart below shows the returns of funds within the portfolios for the quarter.

Our bond funds provided significant protection from the worst excess of the bond markets with our short duration Gilt fund down 4.0%, whereas the wider Gilt market lost over 13%. Our credit funds also protected against the worst of the falls in the bond markets with the M&G UK Inflation Linked Corporate Bond Fund, Twenty-Four ARC and Vanguard UK Short Term Investment Grade falling 3.5%, 2.4% and 6.4% respectively. The Sterling corporate bond market fell 12.5% over the quarter. We continue to hold duration short while we are in a rate rising environment, but also recognise that bonds may start to offer better value when we see the end of this cycle. At the moment the protection from the permanent loss of capital is key in fixed income.

On average our active equity funds gained 2.1% over the quarter, while our passive equivalents fell 0.2%. The vast majority of our equity funds provided positive performance over the quarter with Stewart Asia Pacific Leaders gaining 7.8%, Lindsell Train Global 6.0%, Lindsell Train UK 3.7%, Brown US Sustainability 3.1% and Blue Whale Growth 2.1%. Only Liontrust Special Situations (-1.1%) and Matthews Asia ex Japan Dividend (-5.5%) posted negative returns. This strong performance from our equity funds added to our overall outperformance over the quarter.

We remain committed to our equity growth bias within portfolios, not least because the majority of our funds have continued to report that their underlying holdings have on average continued to grow their earnings over the year. We invest for the long-term growth in earnings rather than try to trade the valuation cycle.

Portfolio outlook

We made no changes to the portfolios over the quarter. Overall, our long-term outlook remains unchanged.

- Equilibrium rates will remain lower than they were pre GFC but higher than the previous decade. Real rates will remain negative for a prolonged period of time

- Inflation is set to become more volatile over the next decade

- We must adjust to permanently lower risk premia. We get paid less for taking on the same risk

- Monetary policy is now ineffective as a tool to combat future recessions

- Fiscal policy will have to take up the slack with ever expanding government balance sheets

- Fiscal policy will remain loose for much longer to combat the effects of the Covid-19 pandemic and sluggish demand

- Global demand and growth will remain weak while inflation and geo-political risk remain high

- Outlook for fixed income is poor as central banks look to combat inflation with rate rises in the short-term

- Equities still provide resilience but only those companies with pricing power, strong balance sheets, good cash flows, strong brands and barriers to entry will provide long-term value

Find out how One Four Nine Portfolio Management invest here.

Dr Bevan Blair,

Chief Investment Officer,

One Four Nine Portfolio Management

London, Tuesday 02 August 2022.

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.

All data is at 30 September 2022. One Four Nine Models are benchmarked against UK CPI and any other benchmark has been displayed for comparative purposes only and is not a benchmark for the Models. Performance figures are net of underlying fund fees and include One Four Nine Portfolio Management’s Management Fee of 0.24% (including VAT). All model portfolio performance data is sourced from One Four Nine Portfolio Management. All other data is from Bloomberg and Morningstar.

This service is intended for use by investment professionals only. This document does not constitute personal advice. If you are in doubt as to the suitability of an investment, please contact your adviser.

One Four Nine Group Limited Registered in England No: 11866793. One Four Nine Portfolio Management Limited is registered in England No: 11871594 and is authorised and regulated by the Financial Conduct Authority (FCA) FRN: 931954. One Four Nine® is a registered trademark.