Portfolio Review – Q2 2022 – Issue 15

This is the latest One Four Nine Portfolio Management (OFNPM) portfolio review providing investors and advisers with an easy to digest overview of what’s happening in the markets globally, alongside comparisons of OFNPM’s portfolio performance each quarter and throughout the year.

Chief Investment Officer’s comments

We are probably in a recession, or at least the US is probably in a recession. At the moment it is probably quite shallow with the US economy stagnating rather than retrenching, but nevertheless this is a poor outcome for the world in general as the debt fuelled bounce from the lows of the pandemic comes to an abrupt end. Couple this with still rising inflation and we are definitely in a stagflation environment.

Inflation shows no signs of coming under control despite rapid rate increases. In most economies it continues to surprise on the upside. In the US inflation is now running at 9.1%, up from 8.5% at the end of March. It is a similar story in the UK (9.4% against 7.0% in March) and Europe (8.6% against 7.4% in March). Even Japan is showing signs of increasing inflation with the rate now at 2.4%. While this is significantly lower than the rest of the world it is high relative to its history since 1990.

Central banks around the world have been aggressively raising their base rates to tackle inflation. In the US the Federal Reserve has raised its target rate three times from 0.5% to 2.50%. The Bank of England has been more circumspect but still has raised its base rate twice from 0.75% to 1.25%, its highest since the great financial crisis in 2008. Elsewhere the Australian, New Zealand and Canadian central banks have all raised rates three times to leave their base rates at 1.35%, 2.50% and 2.50% respectively. Even the ECB has finally got in on the act raising its base rate from -0.50% to 0% with the likelihood of more to come.

In these rate rises we have seen the genesis of a recessionary environment with GDP slowing in most countries. The IMF has already downgraded its expectations for world growth from 3.6% to 3.2% for 2022, which is far lower than the 6.1% growth the world experienced in 2021 and is below its long-term average. This is the second downgrade this year by the IMF which downgraded its forecast for 2022 from 4.4% to 3.6% in Q1. The US is in a technical recession with two consecutive quarters of negative growth, albeit at the margins with growth of -0.4% and -0.2% for Q1 and Q2. While the rest of world has yet to follow suit in recording a contraction in GDP, the UK and the Eurozone are not far behind, and the market awaits Q2 data with bated breath.

Recession a lesser evil

Central banks have taken the decision that recession is a lesser evil than inflation. The cost of aggressively targeting inflation will be recession or at best substantially below trend economic growth. The big problem that central banks face is that the current and anticipated rate increases may not be enough to control inflation or bring it back in line with targets. This is because governments continue to expand their own balance sheets with loose fiscal policy and ever-increasing levels of debt, substantial fuel for inflation. Loose fiscal policy and tight monetary policy are opposing forces. To really control inflation governments will need to reduce fiscal imbalances, either through tax rises or spending cuts, all while central banks reduce money supply. This of course could be significantly contractionary for economies and the risk is that it will deepen any potential recessions.

There are signs that central banks’ policies are starting to have an effect. While this has not been seen in consumer price data yet, we are starting to see falling rates of producer price inflation. Moreover, the rate of growth in the broad money supply has fallen to zero, where as a year ago we had double digit growth in the money supply. If it continues, this should start to feed through into falling rates of inflation, but it may take till the end of the year to show through in the headline inflation data. Markets are already starting to price in rate cuts as early as quarter one of 2023, although the probability is low.

Market Performance

Markets have reacted to this situation by selling off significantly in the second quarter. Both bond and equity markets have suffered substantial falls thanks to rising rates and recessionary fears.

The source of bond market performance has primarily been the market’s expectations of rate rises to combat high inflation, whereas the source of equity-market performance has been the markets nervousness about these rate increases causing a recession. All markets suffered significant falls over the quarter and there were few places to hide.

Gilts fell 7.9% over the quarter as yields rose. The UK ten-year yield rose from 1.61% to 2.22% over the quarter. At one point during the quarter yields rose as high as 2.6% before falling back slightly. Investment grade sterling bonds fared little better with the index down just under 7.8%. The longer your duration, the worst your performance and so short-dated Gilts fell just 0.9% over the quarter but long dated inflation-linked gilts fell 18.1%. This was true globally with US treasuries falling 3.9% and European government bonds falling 7.3%. For Gilts the falls in Q1 were the biggest quarterly fall in well over 40 years and returns in Q2 matched this!

Global equities fell 9.1% in sterling terms over the quarter, the biggest quarterly fall since Q1 of 2020. Growth stocks (-14%) continued to underperform value stocks (-4%), a continuation of the rotation between value and growth seen last quarter. However, as we moved through the quarter the selloff became more broad based and was reminiscent of an equity market worried about the recessionary effects of rate rises. Cyclical sectors performed particularly poorly with consumer discretionary down 17%, materials 13% and financials 9%. The fall in consumer discretionary is a reaction to higher inflation and lower wage growth squeezing consumers income and the resulting drop in demand for “luxuries”. The fall in materials would suggest a market worried by a drop in aggregate demand as commodity prices fall and falls in financials would suggest that markets are worried about the possibility of increased credit defaults both at the corporate and individual level.

Energy was again the best performing sector, but only rose just under 3%, as oil prices stabilised and traded in a range between $100 and $120 a barrel. Just behind energy though was consumer staples which gained 1.5% over the quarter, surely a sign that markets think we are heading into a recessionary environment and that the consumer will look to prioritise spending towards every day needs rather than wants.

Small cap stocks continued to underperform their large cap counterparts with the MSCI small cap index falling 10.2%, while large caps fell 9.0%.

Commodity markets also reacted to the fear of recession. Industrial metals, (zinc, copper, lead, nickel, aluminum) fell between 20% and 30% over the quarter. Energy commodities continued to rise, but the quantum was much reduced with oil gaining just over 6%. Soft commodities in general also fell back with double digit falls in cotton, cocoa and wheat. There has been a particular focus on the supply and price of wheat due to the on-going war in the Ukraine. Wheat prices fell 13% over the quarter and the price of wheat is now back to the levels seen in early February before the start of the war.

And finally, we have experienced significant US dollar strength over the quarter. The dollar index, a trade weighted index of the USD, appreciated 6.5% over the quarter, its strongest quarter since Q4 2016. This is generally seen as a sign that market participants are “worried” and are looking to place assets in the worlds reserve currency.

Portfolio performance

Your portfolios generated negative performance over the quarter. The table below shows returns for Active and Passive portfolios, alongside the returns of their respective inflation benchmarks and for comparison purposes their appropriate IA sector over the quarter.

| 3 Months to 30 June 2022 | Active | Passive | Sustainable | Inflation Benchmark | IA Sector |

| Defensive | -3.23% | -2.58% | -4.32% | 4.32% | |

| Cautious | -3.89% | -3.26% | -5.31% | 4.54% | -6.06% |

| Balanced | -5.56% | -4.76% | -6.87% | 4.76% | -6.42% |

| Growth | -6.82% | -5.88% | -7.99% | 4.97% | -7.45% |

| Adventurous | -8.16% | -7.09% | -8.83 | 5.19 |

Our active portfolios slightly underperformed the passive portfolios over the quarter. This was driven by most of our equity funds underperforming their benchmarks, however the underperformance was small, especially given our growth bias in portfolios. Our funds benefited from their overweight to consumer staples, however this was tempered by our large allocation to consumer discretionary. The net result was that, given our factor exposures, most of our funds generated positive returns from stock selection. Both ranges outperformed their sector averages, especially at the lower risk end where our short duration bond positioning continued to protect us from the worst of returns in the bond market.

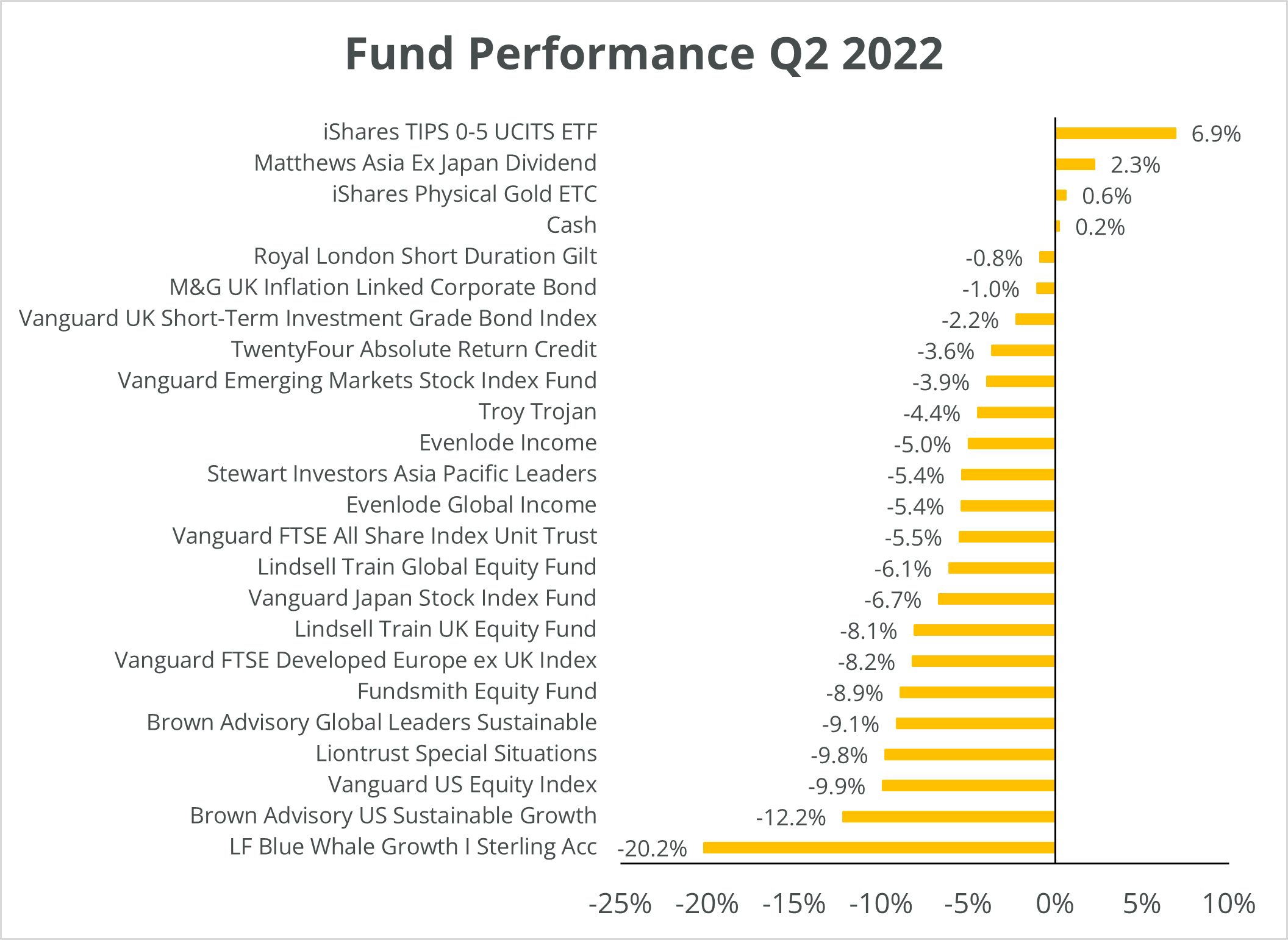

The chart below shows the returns of funds within the portfolios for the quarter.

Our short duration bond funds were some of the best performers over the quarter delivering small negative returns. Our short duration Gilt fund fell 0.9%, whereas the wider Gilt market lost over 7.9%. Our credit funds also protected against the worst of the falls in the bond markets with the M&G UK Inflation Linked Corporate Bond Fund, Twenty-Four ARC and Vanguard UK Short Term Investment Grade falling 1.0%, 3.6% and 2.2% respectively. The Sterling corporate bond market fell 7.8% over the quarter. We continue to hold duration short while we are in a rate rising environment, but also recognise that bonds may start to offer better value when we see the end of this cycle. At the moment the protection from the permanent loss of capital is key in fixed income.

On average our active equity funds fell 8.7% over the quarter, while our passive equivalents fell 7.7%. The worst performing funds were those funds with a significant growth bias, however given that growth underperformed value by over 10% in the quarter the quantum of their underperformance implied that there was positive return from their stock selection. All but one of our global funds outperformed the MSCI World over the quarter. Those funds with a higher allocation to consumer staples (Lindsell Train Global and Evenlode Global Income in particular) did so by considerable margins.

We remain committed to our equity growth bias within portfolios, not least because the majority of our funds have continued to report that their underlying holdings have on average continued to grow their earnings over the year. We invest for the long-term growth in earnings rather than try to trade the valuation cycle.

Portfolio outlook

We made no changes to the portfolios over the quarter. Overall, our long-term outlook remains unchanged.

- Equilibrium rates will be at far lower levels than they were pre GFC for much longer. Real rates will remain negative for a prolonged period of time

- We must adjust to permanently lower risk premia. We get paid less for taking on the same risk

- Monetary policy is now ineffective as a tool to combat future recessions

- Fiscal policy will have to take up the slack with ever expanding government balance sheets

- Fiscal policy will remain loose for much longer to combat the effects of the Covid-19 pandemic and sluggish demand

- Global demand and growth will remain weak while inflation and geo-political risk remain high

- Outlook for fixed income is poor as central banks look to combat inflation with rate rises in the short-term

- Equities still provide resilience but only those companies with strong balance sheets, good cash flows, strong brands and barriers to entry will provide long-term value

Find out how One Four Nine Portfolio Management invest here.

Dr Bevan Blair,

Chief Investment Officer,

One Four Nine Portfolio Management

London, Tuesday 02 August 2022.

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.

All data is at 30 June 2022. One Four Nine Models are benchmarked against UK CPI and any other benchmark has been displayed for comparative purposes only and is not a benchmark for the Models. Performance figures are net of underlying fund fees and include One Four Nine Portfolio Management’s Management Fee of 0.24% (including VAT). All model portfolio performance data is sourced from One Four Nine Portfolio Management. All other data is from Bloomberg and Morningstar.

This service is intended for use by investment professionals only. This document does not constitute personal advice. If you are in doubt as to the suitability of an investment, please contact your adviser.

One Four Nine Group Limited Registered in England No: 11866793. One Four Nine Portfolio Management Limited is registered in England No: 11871594 and is authorised and regulated by the Financial Conduct Authority (FCA) FRN: 931954. One Four Nine® is a registered trademark.