Portfolio Review – Q1 2023 – Issue 18

This is the latest One Four Nine Portfolio Management (OFNPM) portfolio review providing investors and advisers with an easy to digest overview of what’s happening in the markets globally, alongside comparisons of OFNPM’s portfolio performance each quarter and throughout the year.

Chief Investment Officer’s comments

The main macroeconomic themes of 2022 continued into the first quarter of 2023. Higher than target inflation, rising interest rates and lower than needed growth. What is different is that the future path of interest rates is much less certain than it was even three months ago.

Inflation has been the driver of rate rises, and it has remained stubbornly high, and while in most economies it appears to have peaked and is starting to fall, it has not fallen fast enough for central banks’ liking. Moreover, core inflation (inflation less energy and food, whose prices are more cyclical and therefore less sensitive to rate rises) has plateaued and is not showing signs of falling. In fact, core inflation in the US and the UK is still rising. This matters because core inflation is considered to be the most sensitive part, of the basket of goods and services in the inflation calculation, to interest rate changes. If, with all the rate increases we have had over the past 15 months, core inflation is still not under control then the actions of central banks have either failed or have not gone far enough.

This is where the uncertainty comes into play. At the beginning of the quarter markets were pricing in no more than two or three more rate rises in both the US and the UK, and for the current cycle to end by the second quarter of 2023. During January, Federal Reserve members had been moderating their language around the future path of interest rates confirming the markets’ thoughts. However, by the middle of February the tone, if not the content, of members’ pronouncements had shifted markedly to a much more hawkish stance.

To paraphrase: “You the market are underestimating the effects of core inflation, we the Fed are much more concerned of its future path, and we will do everything necessary to bring it under control – so expect more rate rises for longer”.

The market took note as expectations shifted upwards significantly. By early March expectations for the Fed Funds rate at the end of September 2023 had moved up from 4.77% at the end of January to 5.69%. The market was expecting at least four 25 basis point moves more than they were in January. They had already got one of those during the early February meeting as the target rate moved from 4.5% to 4.75% but now more were coming.

Everything changed – Silicon Valley Bank

Then everything changed over the weekend of 11 and 12 March as Silicon Valley Bank (SVB), a major banking partner for technology firms backed by venture capital effectively went bust. This was followed quickly by the insolvency of another US bank, Signature. The reasons for the insolvencies were partly due to the rising rate environment as they took depositors’ money and invested part of it in long-dated treasuries rather than lending it to commercial operations. These long-dated treasuries were mark-to-market on the balance sheet and the losses due to rising rates were starting to bite. When depositors started demanding their cash back the value was no longer there to back them up. A good old-fashioned run on a bank, exacerbated by technology allowing withdrawals at the click of a button, alongside falling asset values caused a failure of the institutions.

Markets consequently started to worry about the solvency of the US banking system. Rate expectations when markets opened on Monday 13 March dropped from 5.2% on the Friday to 3.9%. Market expectations have been turned on their head with the markets now expecting rate cuts by the end of the year. The Fed has also had to respond to this crisis by shoring up smaller regional banks in the US. This has been evidenced by a very quick reversal of the quantitative tightening programme the Fed has been implementing since mid-2022. The Fed injected $300 billion into the US banking system the week after SVB went bust and then a further $100 billion a week later. They have returned to their tightening programme, but the two weeks of quantitative easing wiped out six months of quantitative tightening.

What the market has feared most, a contagion effect in the banking system, has not transpired as of yet and rate expectations have been drifting upwards again, however the future path of interest rates is still highly uncertain. Allied to this, although somewhat independent, has been the forced takeover of Credit Suisse by UBS. This was pushed through by the Swiss National Bank (SNB) as it became clear that Credit Suisse was in trouble. The market had been for some time suggesting that all was not right within Credit Suisse, as its credit default swap rates were significantly higher than similar European banks, however the forced takeover still took the markets by surprise.

Ripping up the playbook

What was most surprising was how the takeover was funded. Credit Suisse stockholders gained shares in UBS, but some bond holders were wiped out. This is unusual because it is normally the equity holders who are at the back of the queue, but here the SNB ripped up the waterfall of the capital stack. At issue were the holders of Additional Tier One (AT1) capital. These are sometimes called Co-Co Bonds (Contingent Convertibles) and are considered to sit above equity holders in the capital hierarchy. They are debt instruments but with the ability for them to be converted into equity should there be a run on the equity in a bank. Most banks have AT1 securities and they form part of the capital of a bank. Should the equity value fall to a point where the bank starts to look insolvent the bank can convert them to equity, shoring up its equity and returning to solvency, or so the theory goes. These are widely held by bond investors and are considered less risky than equity. At least that was the case until the SNB ripped up this playbook. The bonds were rendered worthless, while equity holders managed to hold onto something at least. This naturally had an effect on the whole AT1 market with bonds being marked down by more than 10% in some instances on well capitalised banks.

So, we consider the path of future rate rises is now even more unclear. The market is worried about inflation, as still are central banks, but it is now equally worried about the solvency of the banking system as a whole and the effect rate rises are starting to have on the wider economy. Yet the environment for fixed income is now materially different. As at the end of March 2023 we are forecasting the cash return to be 4.20% p.a., Gilts to return 3.49% and investment grade (IG) credit to return 5.08%. We now feel that we are being rewarded for taking on risk in fixed income.

There is growing evidence that the rate rises from last year are starting to have an impact on economic activity. The hikes from the first half of 2022 are only now starting to be felt in the economy and markets. The rate rises from the second half of 2022, which were higher than the first half will not have their full effect felt until the second half of 2023. It is this lag-effect that worries us. Economic activity is at best anemic globally and both UK and Europe are worryingly close to recessionary conditions. Growth in the US is more robust, but still below long-term trends. We are also starting to see a fall in earnings for equities. In the last three months earnings have fallen across all developed economies. In Japan earnings have fallen 6.7% on average over the past three months, in the US 4.1%, the UK 4.7% and Europe 2.8%. This is not a conducive environment for equity markets.

Our forecasts for equities though are much better than they were two years ago. Back then we were forecasting global equities to return 3% p.a. over the next 10 years. Today the expectation is for equities to return just over 6% p.a. for the next 10 years. While our models are suggesting a much better long-term return there remains significant short-term risks, as evidenced by falling earnings and slowing economies. Falls in equity markets last year released significant pressure on valuations, but as we see rising equity markets and falling earnings these valuations will come under pressure again. Therefore, we do not feel now is the right time to extend equities. We are however heartened by the fact that our equity fund managers are seeing a better earnings environment for their underlying companies. The companies they invest in, tend to have low leverage, sustainable business franchises, strong balance sheets and growing dividends and should withstand market turbulence better than the average company.

With cash starting to offer some decent nominal returns, bonds through the worst of the rate rises, and equities at a better valuation point, there is a significantly higher probability that a balanced portfolio performs better than over the last two years, providing positive return and providing some diversification. For those that have been uninvested now is a better point to enter the market, and for those that have ridden the wave, there is much to be hopeful about for recovery in hard earned capital.

Market Performance

Sterling bond markets made a small recovery over the quarter as yields eased back globally, despite the mixed messages from Central Banks. Gilts overall gained 2.3%, with longer dated Gilts outperforming shorter dated ones. Short-dated 1-5 year Gilts gained 1.0% over the quarter while long-dated 10 year plus Gilts gained 3.0%. Index linked Gilts outperformed nominal Gilts gaining 4.2% over the quarter, although this is almost all down to the long-duration nature of the instruments rather than a trade in inflation expectations.

Sterling investment grade credit out-performed Gilts slightly over the quarter gaining 2.5%. Sterling high yield bonds gained 3.8%, outperforming investment grade, although this was pared back over March as the market digested the fallout from the loss of value of bank AT1 securities in the wake of the takeover of Credit Suisse by UBS. Short-dated sterling investment grade bonds, where the majority of our portfolios are invested, gained 1.8% over the quarter outperforming short-dated Gilts.

Equity markets generated positive returns last quarter as participants anticipated possible rate cuts later in the year. This despite earnings weakening across developed economies in the first quarter. The MSCI World in Sterling terms gained 4.8% over the quarter but there was considerable disparity between geographies and sectors.

The UK was the worst performing developed region over the quarter, with the MSCI UK Index up 3.2%. This was due mainly to the large weight the UK has to bank and energy stocks which performed poorly over the quarter. Japanese and US equities gained over 7% in local currency terms over the quarter while the pick of regions was Europe ex UK which gained over 9% in sterling terms. Returns in emerging markets were more muted gaining just 1.1%.

In the UK small cap stocks underperformed large caps stocks with the small cap index down 1.3%, while large caps gained 3.6%. Likewise mid-caps also underperformed large caps in the UK, but at least turned a positive return of 1.0%. This was repeated global with MSCI Small Cap index up 1.5%, but the large cap up 5.4%.

Growth stocks led the global rally gaining just under 12.0% while value stocks retreated 1.8%. There were significant sectorial differences over the quarter. One of the worst performing sectors over the quarter was financials, led by the sell-off in bank stocks in March after the SVB and Credit Suisse debacle. Financials fell 4.3% in sterling terms over the quarter. Energy stocks (-6.0%) were the worst performing sector, as oil and gas prices stagnated, and investors looked to take profits in the face of potential falls in demand due to a worsening economic outlook. However, the best performing sectors were Information Technology up 17.8% and Consumer Discretionary up 13.3%, bouncing back from losses in the last quarter of 2022.

Oil continued to weaken with the price falling just under 5%, although a lot of this was reversed in the first week of April as OPEC announced a reduction in production targets. Gold had another good quarter rising 8% to nearly $2,000 an ounce, clearly a sign that some market participants are hedging their bets on recession and inflation. The dollar continued to weaken with the trade weighted dollar index down just over 1%. Sterling gained 2% against the dollar placing cable back at levels last achieved in May of 2022. Over the past six months Sterling has rallied over 10% against the dollar, although this performance has been more muted against other currencies.

Portfolio performance

Your portfolios generated positive returns over the quarter, with higher risk portfolios outperforming lower risk portfolios. The table below shows returns for Active, Passive and Sustainable portfolios, alongside the returns of their respective inflation benchmarks and for comparison purposes their appropriate IA sector over the quarter.

| 3 Months to 31 March 2023 | Active | Passive | Sustainable | Inflation Benchmark | IA Sector |

| Defensive | 1.86% | 1.92% | 2.02% | 0.95% | |

| Cautious | 2.20% | 2.21% | 2.47% | 1.19% | 1.65% |

| Balanced | 3.12% | 2.88% | 3.20% | 1.42% | 1.61% |

| Growth | 3.90% | 3.41% | 3.70% | 1.66% | 2.25% |

| Adventurous | 4.74% | 3.96% | 3.89 | 1.89 |

Source: Bloomberg

Our active portfolios outperformed the passive portfolios over the quarter. This was driven by a number of our equity funds outperforming their benchmarks, benefiting from their growth bias as growth outperformed value. There was also a relative benefit to our funds form most of their zero weight to banks over the quarter which suffered significantly in the wake of the failure of SVB and the takeover of Credit Suisse by UBS. While our short duration bonds performed well over the quarter, they were behind longer duration funds as yields compressed slightly. One of our funds, TwentyFour Absolute Return Credit Fund, did underperform due to its exposure to European bank AT1 securities, which were sold off in the wake of Credit Suisse AT1 debt being rendered worthless by the Swiss Central Bank. The fund held a minor position in Credit Suisse securities and this combined with the contagion effect did mean some underperformance over the quarter. However, the fund still returned a positive return over the quarter.

Overall our portfolios outperformed their relative IA sectors, and for the first time in a while our inflation benchmarks over the quarter!

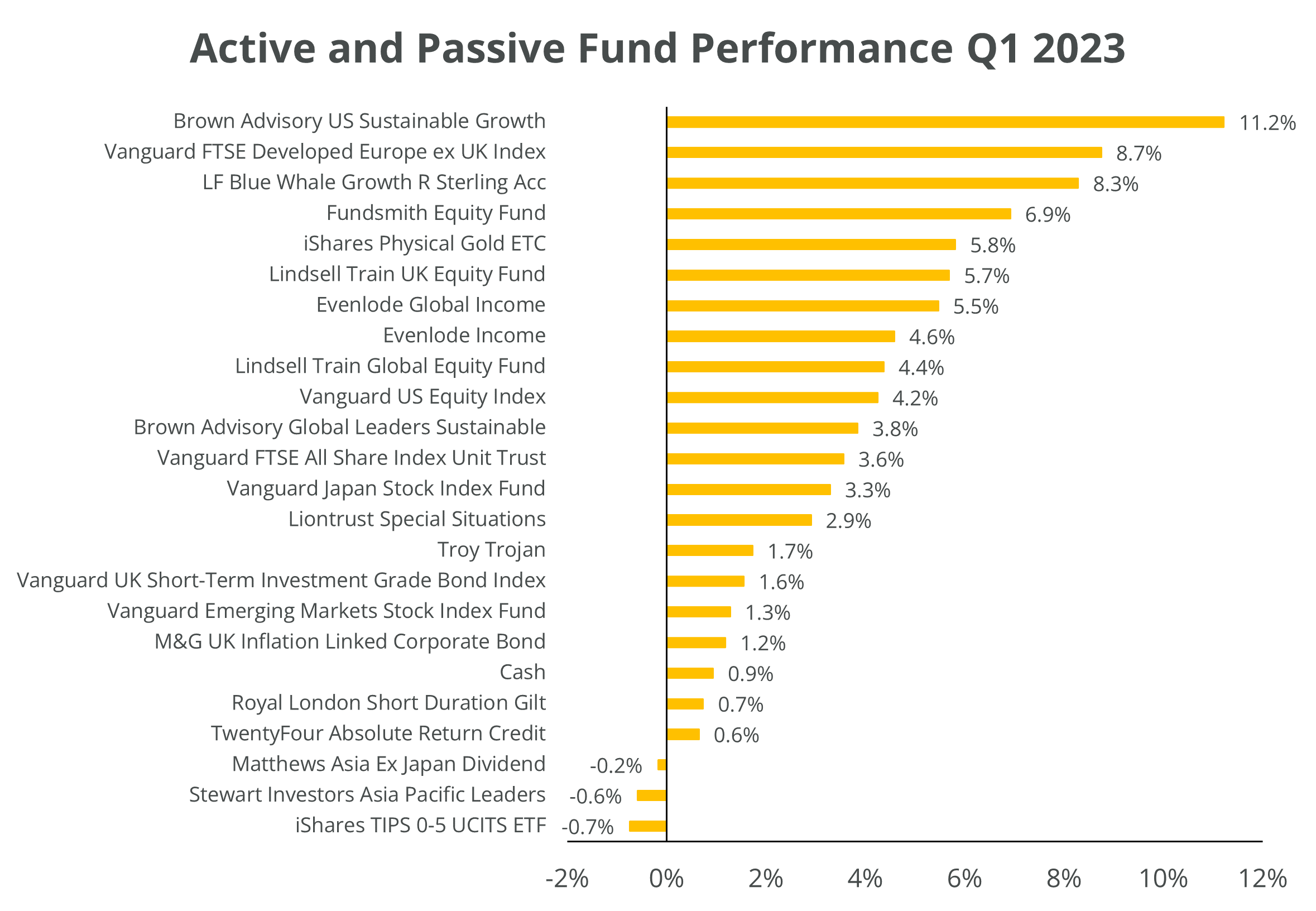

The chart below shows the returns of funds within the portfolios for the quarter.

Source: Bloomberg

All of our bond funds, both active and passive, posted positive returns over the quarter. M&G UK Inflation Linked Corporate Bond fund was the best active performer up 1.2% over the quarter, while the passive Vanguard UK Short-Term Investment Grade Bond Index was up 1.5%. As has been discussed TwentyFour Absolute Return Credit lagged behind but still posted a positive return of 0.6%. Our short-dated Gilt tracker gained 0.7% and wider Gilts gained 2.3%. Overall, our bond funds gained 0.9% over the quarter.

Our active equity funds returned on average 5.1% over the quarter while their passive equivalents returned 4.2%. The best performing equity funds were those that had a significant growth bias and those with low or zero weights to banks and energy stocks. The best performer was Brown Advisory US Sustainable Growth which gained over 11% over the quarter, followed by Blue Whale Global Growth, which recovered just over 8% after a poor 2022. Our UK equity funds performed well with both Lindsell Train UK (+5.7%) and Evenlode Income (+4.6%) outperforming the Vanguard UK Index fund (+3.6%). Our global equity funds were again a good source of return with 3 of the 5 outperforming the MSCI World, with the other two close behind.

We remain committed to our equity growth bias within portfolios, not least because the majority of our funds have continued to report that their underlying holdings have on average grown their earnings over the year. Not a feature that we have seen in the market as a whole. We invest for the long-term growth in earnings rather than try to trade the valuation cycle.

Portfolio outlook

We made no changes to the portfolios over the quarter. Overall, our long-term outlook remains unchanged, but there are now some medium-term opportunities in bonds. Expected returns for all asset classes look much better than they did a year ago and there is some room to add risk in portfolios, mindful that if the recessionary conditions worsen that there will be short-term pain. The balance of probabilities is for better long-term performance from portfolios.

Find out how One Four Nine Portfolio Management invest here.

Dr Bevan Blair,

Chief Investment Officer,

One Four Nine Portfolio Management

London, Monday 24 April 2023.

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.

All data is at 31 March 2023. One Four Nine Models are benchmarked against UK CPI and any other benchmark has been displayed for comparative purposes only and is not a benchmark for the Models. Performance figures are net of underlying fund fees and include One Four Nine Portfolio Management’s Management Fee of 0.24% (including VAT). All model portfolio performance data is sourced from One Four Nine Portfolio Management. All other data is from Bloomberg and Morningstar.

This service is intended for use by investment professionals only. This document does not constitute personal advice. If you are in doubt as to the suitability of an investment, please contact your adviser.

One Four Nine Group Limited Registered in England No: 11866793. One Four Nine Portfolio Management Limited is registered in England No: 11871594 and is authorised and regulated by the Financial Conduct Authority (FCA) FRN: 931954. One Four Nine® is a registered trademark.