Portfolio Review – Q1 2022 – Issue 14

This is the latest One Four Nine Portfolio Management (OFNPM) portfolio review providing investors and advisers with an easy to digest overview of what’s happening in the markets globally, alongside comparisons of OFNPM’s portfolio performance each quarter and throughout the year.

Chief Investment Officer’s comments

The start of the year has seen significant falls in almost all markets. The genesis of which has been two-fold. Firstly, inflation remains stubbornly high in all western economies apart from Japan. In the UK inflation as measured by CPI stood at 7.0% at the end of March.

RPI, which a number of regulated prices feed off, was 9.0%. In the US and Europe inflation was 8.5% and 7.4% respectively. This is the highest level of inflation we have seen in a generation and has been caused by several factors, not least increased demand as Covid restrictions ease significantly (or disappear completely as in the case of the UK) coupled with supply chains that are still struggling to keep up with the increased demand.

Secondly, we have seen a large increase in the cost of energy over the past few months, which has been driven in part by the ongoing uncertainty generated by Russia’s war against Ukraine. While energy prices had been increasing in 2021, not least gas prices in Europe, the war in Ukraine accelerated these increases pushing the price of a barrel of Oil over $100 for the first time since 2014. And it hasn’t just been energy prices that have seen a short-term increase. Industrial metals for the most part saw a large price rise on the back of war commencing, and importantly soft commodities, in particular wheat have experienced large price increases. These all feed into the underlying rate of increase in CPI, and while firms try to absorb some of the short-term increase, eventually they must pass them on to the consumer.

Heading off higher inflation

Central banks have therefore been called to action to head off higher inflation, already well above target levels at the end of 2021. What worries central banks is not the rate of inflation, but the surprises to that rate. Almost every economy this year has recorded inflation rates above expectations. Central banks have responded by commencing rate rises to control inflation, firstly the Bank of England (BOE) and secondly the Federal Reserve. The European Central Bank have held off from raising rates thus far.

The BOE raised the base rate twice during the quarter from 0.25% to 0.75%. The Federal Reserve raised the upper bound of the Fed Funds rate from 0.25% to 0.50%. However, both banks communicated to the market that this was just the start of a concerted programme to get inflation under control. The market is now expecting that there will be six more 0.25% rises in the base rate in the UK bringing the rate to 2% by the end of the year. In the US the Fed is being even more aggressive with the market now expecting eight 0.25% rise by the end of the year, leaving the Feds target rate at 2.5%. Even the ECB is in on the act and whilst not raising rates have given themselves room to increase rates (from -0.50%) if they see inflation out of control.

Central banks though must tread carefully. While most have one remit, which is to control inflation, they try to balance rising rates with the slowing effect they have on economic growth. While growth rates have been high coming out of the pandemic it has been considered that this will be a temporary phenomenon and that growth would return to a much lower level in 2022. Place a rising rate environment on top of high inflation into a slowing growth market and the risk that central banks run is that they slow economic growth too much. Already there is a higher probability of short-term stagflation (a low growth environment with high inflation) and a miss step by central banks could risk moving economies into recession, even as prices rise.

Slow global growth

Global growth is already slowing, and the IMF have downgraded global growth from 4.4% to 3.6% for 2022. In the US first quarter GDP showed a small contraction in the economy when the market was expecting a small expansion. There are significant risks to rate rises slowing economic growth, and it may be already happening, before we even see the expected rate rises. This may of course cool inflation and there is every likelihood that we start to see a fall in the headline rate in the summer as base effects work their way out of the system. Also, there are signs that the increases in energy prices have at least stalled, although they will take a while to work their way out of the rate, as the stalling does not imply falling prices.

If the inflation rate does start to fall in the next few months, this may well temper the need to raise rates across all central banks, which will have a beneficial effect on both equity and bond markets as discount rates either fall or at least don’t rise further. If it does not then we could expect more pain in both markets, with diversification offering little protection, and a repeat of the quarter just gone.

Market Performance

The source of market performance has primarily been the market’s expectations of rate rises. This has manifested itself most dramatically in the bond markets with significant falls in both sovereign and credit markets. The equity market has not been immune, and while the falls over the quarter have not been large, there has been a significant rotation from growth stocks to value stocks and significant positive performance in one sector in particular, energy, which has driven most other sectors down.

Gilts fell 7.5% over the quarter as yields rose. The UK ten-year yield rose from 0.97% to 1.61% over the quarter. Investment grade sterling bonds fared little better with the index down just under 7%. The longer your duration, the worst your performance and so short-dated Gilts fell just 1.7% over the quarter but long dated inflation-linked gilts fell 11.20%. This was true globally with US treasuries falling 6.6% and European government bonds falling 5.3%. For Gilts this is the biggest quarterly fall in well over 40 years.

At the same time equity markets also suffered falls. The prospect of higher interest rates caused discount rates for equities to rise, and so the price of equities fell. If you are discounting future cashflows at higher rates the net present value of those cashflows will fall. Those with higher cashflows further out will suffer the biggest falls. Global equities fell 2.4% in sterling terms over the quarter but there was a disconnect between “value” and “growth” stocks. Value stocks rose over the quarter, gaining 2.2%, but growth stocks, who are more sensitive to rate rises as their earnings are further out in time, fell 7.1%. This rotation between growth and value can be best seen when we look at the returns on a sectorial basis.

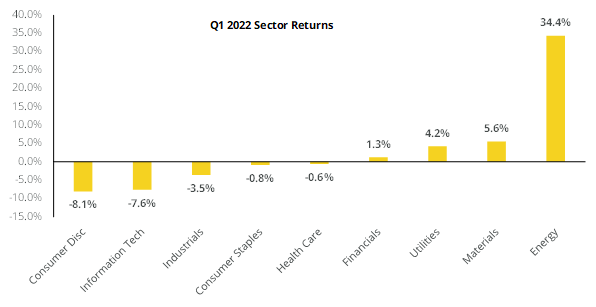

The chart below shows the returns of global sectors over the quarter.

The standout sector has been global energy stocks, which gained 34.4% over the quarter. Basic materials, utilities and financials also posted strong positive returns, but not on the scale of energy stocks. These are all predominately value sectors. On the flip side technology and consumer discretionary sectors, which are more naturally dominated by growth stocks, were the biggest losers falling 7.6% and 8.1% respectively. Of course, energy stocks benefited from surging underlying prices, but were also helped by their lower sensitivity to rate rises.

The effect is most pronounced in the UK, where the broad market was up 0.50%, but was dominated by a handful of stocks. Large cap oil, mining, tobacco, and bank stocks made up around 22% of the index at the beginning of the quarter. They returned just over 20% on average over the quarter. This implies that the remaining 78% of stocks fell just over 5% on average. A manager who was not invested in these value sectors had a torrid time over the quarter and those who were more invested in technology and digital stocks suffered disproportionately.

Small cap also suffered over the quarter falling 3.8% while large cap equities fell 2%. In the UK this was more pronounced with large cap equities gaining 2.9%, but small cap equities falling 6.2% highlighting the rotation from growth to value, but more importantly the extraordinary outperformance of oil and mining stocks over everything else.

Portfolio performance

Your portfolios generated positive performance over the quarter. The table below shows returns for Active and Passive portfolios, alongside the returns of their respective inflation benchmarks and for comparison purposes their appropriate IA sector over the quarter.

| 3 Months to 31 March 2021 | Active | Passive | Sustainable | Inflation Benchmark | IA Sector |

| Defensive | -2.13% | -1.39% | 1.14% | ||

| Cautious | -2.97% | -1.57% | -4.81% | 1.37% | -3.08% |

| Balanced | -4.38% | -1.82% | -6.26% | 1.61% | -3.37% |

| Growth | -5.52% | -1.94% | -7.33% | 1.84% | -3.69% |

| Adventurous | -6.66% | -2.06% | 1.08 |

Our active portfolios underperformed their passive equivalents over the quarter with some quite large disparity at the riskier end of the risk spectrum. Our funds on the most part tend to have a growth bias and small cap bias and they have suffered from this rotation. We have almost no exposure to oil and mining stocks within the portfolio and have a higher-than-average weight towards technology and digital stocks and consumer staples. Most of our funds underperformed our benchmarks for them and almost none produced a positive return over the quarter. Sustainable funds in general have fallen more than general active funds as the sectors that they actively shun, or can’t allocate to, have performed the best over the quarter. A structural zero weight to oil, mining and tobacco stocks have forced them to seek out more growth-oriented sectors, and in the short term they have suffered for this.

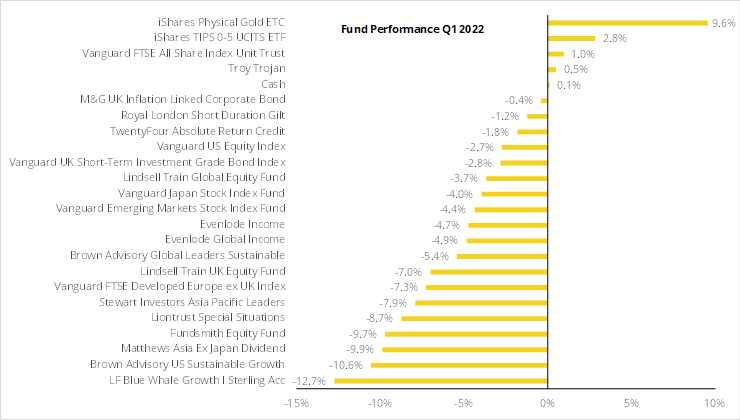

The chart below shows the returns of funds within the portfolios for the quarter.

While at face value this is a disappointing result, we recognise that not being invested in certain sectors has hampered the funds. Take for instance the three UK funds. The Vanguard FTSE All Share Index fund gained 1.0% over the quarter, while the three UK active funds lost 6.8%, an underperformance of 7.8%. However, when compared against the UK index less oil, mining, tobacco, and banks, which fell 5.2% the underperformance turns into 1.6%. We take solace from the fact that none of our managers appear to have reacted in the short term to this rotation, sticking to their investment process, trading only for the long-term benefit of their funds.

We remain committed to our equity growth bias within portfolios, not least because the majority of our funds have continued to report that their underlying holdings have on average continued to grow their earnings over the first quarter. We invest for the long term growth in earnings rather than try to trade the valuation cycle.

Our short duration bond funds fared much better over the quarter delivering small negative returns. Our short duration Gilt fund fell 1.2%, whereas the wider Gilt market lost over 7%. Our credit funds also protected against the worst of the falls in the bond markets with the M&G UK Inflation Linked Corporate Bond Fund, Twenty-Four ARC and Vanguard UK Short Term Investment Grade falling 0.4%, 1.8% and 2.8% respectively. The Sterling corporate bond market gained 6.8% over the quarter. We continue to hold duration short while we are in a rate rising environment, but also recognise that bonds may start to offer better value when we see the end of this cycle. At the moment the protection from the permanent loss of capital is key in fixed income.

Portfolio outlook

We made no changes to the portfolios over the quarter. Overall, our long-term outlook remains unchanged.

- The world is in a secular disinflationary environment. Some short-term inflation is expected due to demand/supply imbalances, but may persist for longer than expected

- Equilibrium rates will be at far lower levels than they were pre GFC for much longer. Covid-19 has compounded this. Real rates will remain negative

- We must adjust to permanently lower risk premia. We get paid less for taking on the same risk

- Monetary policy is now ineffective as a tool to combat future recessions

- Fiscal policy will have to take up the slack with ever expanding government balance sheets

- Fiscal policy will remain loose for much longer to combat the effects of the Covid-19 pandemic and sluggish demand

- Global demand and growth will remain weak while inflation and geo-political risk remain high

- Outlook for fixed income is poor as central banks look to combat inflation with rate rises in the short-term

- Equities still provide resilience but only those companies with strong balance sheets, good cash flows, strong brands and barriers to entry will provide long-term value

Find out how One Four Nine Portfolio Management invest here.

Dr Bevan Blair,

Chief Investment Officer,

One Four Nine Portfolio Management

London, Thursday 12 May 2022.

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.

All data is at 31 March 2022. One Four Nine Models are benchmarked against UK CPI and any other benchmark has been displayed for comparative purposes only and is not a benchmark for the Models. Performance figures are net of underlying fund fees and include One Four Nine Portfolio Management’s Management Fee of 0.24% (including VAT). All model portfolio performance data is sourced from One Four Nine Portfolio Management. All other data is from Bloomberg and Morningstar.

This service is intended for use by investment professionals only. This document does not constitute personal advice. If you are in doubt as to the suitability of an investment, please contact your adviser.

One Four Nine Group Limited Registered in England No: 11866793. One Four Nine Portfolio Management Limited is registered in England No: 11871594 and is authorised and regulated by the Financial Conduct Authority (FCA) FRN: 931954. One Four Nine® is a registered trademark.