Portfolio Review – Q1 2021 – Issue 10

This is the latest One Four Nine Portfolio Management (OFNPM) portfolio review providing investors and advisers with an easy to digest overview of what’s happening in the markets globally, alongside comparisons of OFNPM’s portfolio performance each quarter and throughout the year.

Chief Investment Officer’s comments

Global equity markets ended the first quarter in positive territory, continuing their strong performance from the last quarter of 2020. This was despite concerns regarding increasing Covid-19 cases globally, particularly in India, Brazil, and Turkey.

Patchy vaccine roll-out programs and vaccine nationalism has not helped in the global efforts to bring the pandemic under control.

Countries now in the grips of second and even third waves of the virus are having to re-introduce tighter measures, having prematurely relaxed them slightly, to contain increasing cases and the subsequent pressure placed on already stretched medical facilities and ultimately fatalities. Mass vaccination rollouts coupled with the right measures to prevent spread should give us all hope that this pandemic will eventually end.

Countries such as Israel, the US and Russia have shown promising results from speedy and advanced vaccination programmes. The UK as

well has made excellent progress both in finally suppressing the virus and in its mass vaccination programme.

It is clear that until global health outcomes significantly improve then global economic outcomes will not.

The markets

Markets however looked through all of this to a time when economic growth and demand returns, consumer confidence is strong, and the pandemic has retreated. The consequence was that equity markets continued to produce positive returns. In particular “value” stocks, or rather stocks that had suffered considerable losses in the earlier part of 2020, continued to perform strongly, while “growth” stocks, or those that had shown strong resilience through the middle two quarters of 2020, lagged.

Fixed income markets in particular took this scenario to heart with a significant increase in global inflation expectations. In the US, inflation expectations increased from 2.0% to 2.4% over the quarter with similar moves in the UK (3.0% to 3.6%) and Europe (0.9% to 1.3%).

The theory would go that as vaccine programmes took effect and economies reopened, internally and externally, that pent-up demand from the consumer and business alike over the last year would be unleashed and this would cause demand driven inflation.

Central banks and governments disagree. Most central banks offered subdued growth and inflation outlooks in the medium term and

reiterated their commitment to not raise base rates until the pandemic was truly over.

Governments continued to keep the fiscal tap open. The US in particular offered further “helicopter money” to embattled US citizens with a payment of $1,400 to each taxpayer. The US federal budget debt increased by $1 trillion in the first three months and the total Federal outstanding debt increased by $340 billion over the quarter. In the first two months of 2021 the UK Government borrowed over £20 billion, whereas last year it had net proceeds of £10 billion, a £30 billion deficit swing.

The effect on fixed income markets was stark. In the UK, the 10-year Gilt yield increased from 0.20% to 0.85%, a 0.65% increase. In the US, the 10-year treasury yield increased from 0.91% to 1.79% and in Germany the 10-year Bund yield increased from -0.57% to -0.29%. Due to the low starting point of yields, and the subsequent high duration, the effect on bond returns was devastating. Gilts returned -7.5% over the quarter, the worst return since the BofAML Gilt index was launched in 1985. Sterling investment grade credit fared better losing only 4% over the quarter whilst US treasuries retreated 3.9% and European Government bonds lost 2.2%.

Equities and raw commodities

Thankfully, equities had another good quarter.

The UK market gained 5.2% as did the US market in sterling terms. European equities were more subdued gaining 2.4% and Japanese equities gained just 1.1% over the quarter. Finally, Asia Pacific ex Japan equities advanced 1.8% and Emerging Equities gained 1.3%.

In the UK three sectors disproportionally accounted for the returns. Oil, mining and bank stocks make up around 24% of the index and yet over the quarter they accounted for 75% of the return. Mining companies returned 22.2% over the quarter while banks gained 15.1% and oil stocks 10.2%. All other companies on average gained 1.8%.

On the back of increased demand expectations, raw commodities and in particular oil and industrial metals had a good quarter. Oil gained over 22.5% during the quarter while heating oil gained just under 20%. Copper and aluminium gained 14.3% and 11.9% respectively while zinc and natural gas experienced lower returns of around 2.6%. Gold suffered over a 10% fall as its safe haven status was ignored by investors.

Portfolio performance

Your portfolios mostly generated positive performance over the quarter. We gave up some relative performance as our equity funds mainly ignore the sectors that performed well over the quarter. Our bond funds however had a strong relative quarter as we kept duration as short as we could, thus missing almost all the volatility, and importantly loss, in the asset class. Our two active funds in fact posted positive returns over the quarter.

The table below shows returns for active and passive models, alongside the returns of their respective inflation benchmarks and for

comparison purposes their appropriate private client ARC index.

| Active | Passive | Inflation Benchmark | ARC Index | |

| Defensive | -0.10% | 0.44% | 0.18% | |

| Cautious | 0.06% | 1.03% | 0.43% | 0.09% |

| Balanced | 0.53% | 2.20% | 0.67% | 1.09% |

| Growth | 0.87% | 3.18% | 0.91% | 2.10% |

| Adventurous | 1.31% | 4.28% | 1.15% | 2.90% |

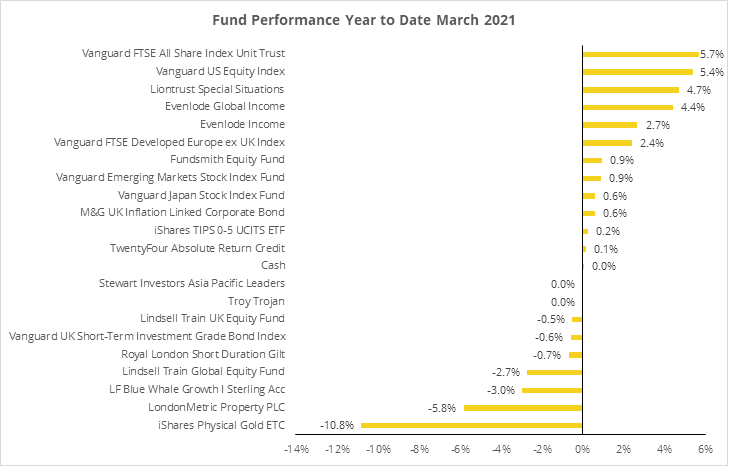

The following chart shows the returns of funds within the portfolios for the quarter.

The five top performers in the active portfolios were:

- Vanguard US Equity (+5.4%)

- Liontrust Special Situations (+4.7%)

- Evenlode Global (+4.4%)

- Evenlode Income (+2.7%)

- Fundsmith (+0.9%)

The bottom 5 performers were:

- Londonmetric (-5.8%)

- Blue Whale Growth (-3.0%)

- Lindsell Train Global Equity (-2.7%)

- Royal London Short Duration Gilt (-0.7%)

- Vanguard UK Short-Term Investment Grade Index (-0.6%)

Our UK funds underperformed the broader index over the quarter which came as no surprise. As we have shown earlier the index return was driven by its weighting in oil, mining, and bank stocks. These sectors make up 25% of the index but accounted for 75% of the return during the quarter. Our UK funds have little or no exposure to these stocks and do not fit the profile of stocks that our fund managers look for. They are operationally geared, generally have weak balance sheets, have low ROIC and their underlying businesses are cyclical in nature. Our managers look for stocks with strong long-term earnings growth with little gearing, strong free cash flows and high ROIC.

The UK index, ex these stocks returned 1.8% over the quarter and against this our funds have better relative performance. Liontrust (+4.7%) and Evenlode Income (+2.7%) both outperformed, while Lindsell Train UK (-0.5%) underperformed. The fact that the funds overall outperformed this adjusted benchmark shows that the resilience of the stock selection in these managers is strong.

Finally, our bond fund selections significantly outperformed bond indices over the quarter. This was mostly due to our asset allocation call to keep duration short. Low duration has meant that we have protected capital in this asset class. Our short duration gilt position fell just 0.7% against a broader market that was down 7.5%. Two out of our three credit funds posted positive returns as M&G UK Inflation Linked Corporate Bond (+0.6%) and TwentyFour Absolute Return Credit (+0.1%) also benefited from short duration and positioning in the BBB sector of the credit curve. Our short duration credit index fund, Vanguard, only lost 0.6% against a broader sterling credit market that lost nearly 4%.

Portfolio outlook

Your portfolios have been unchanged over the quarter. Your portfolios are well placed to deliver their long-term objectives of inflation plus returns and since inception have done so. Our long-term outlook also remains unchanged.

- The world is in a secular disinflationary environment

- Equilibrium rates will be at far lower levels than they were pre GFC for much longer. Covid-19 has compounded this

- We must adjust to permanently lower risk premia. We get paid less for taking on the same risk

- Monetary policy is now ineffective as a tool to combat future recessions

- Fiscal policy will have to take up the slack with ever expanding Government balance sheets

- Fiscal policy will remain loose for much longer to combat the effects of the Covid-19 pandemic

- Global demand and growth will remain weak while Covid-19 remains a risk to global health

- Outlook for fixed income is poor with large amounts of negative yields. Trade is on a greater fool theory

- Equities still provide resilience but only those companies with strong balance sheets, good cash flows, strong brands and barriers to entry will provide long-term value

Find out how One Four Nine Portfolio Management invest here.

Dr Bevan Blair,

Chief Investment Officer,

One Four Nine Portfolio Management

London, Thursday 22 April 2021.

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.

All data is at 31 March 2021. One Four Nine Models are benchmarked against UK CPI and any other benchmark has been displayed for comparative purposes only and is not a benchmark for the Models. Performance figures are net of underlying fund fees and include One Four Nine Portfolio Management’s Management Fee of 0.24% (including VAT). All model portfolio performance data is sourced from One Four Nine Portfolio Management. All other data is from Bloomberg and Morningstar.

This service is intended for use by investment professionals only. This document does not constitute personal advice. If you are in doubt as to the suitability of an investment, please contact your adviser.

One Four Nine Group Limited Registered in England No: 11866793. One Four Nine Portfolio Management Limited is registered in England No: 11871594 and is authorised and regulated by the Financial Conduct Authority (FCA) FRN: 931954. One Four Nine® is a registered trademark.